Russia’s invasion of Ukraine has triggered a humanitarian crisis of extreme proportions, worsening day by day and forcing civilians to flee their country. Faced with this situation, Pergam wishes to express its compassion and sympathy to the Ukrainian people, who have been plunged into a devastating war, and we hope that a solution to this crisis will be found quickly.

Another consequence of this conflict is that inflation is strongly stimulated by rapidly rising commodity prices

From cyclical to structural inflation

After two decades during which China exported disinflation, the global context is moving towards de-globalisation, structurally more expensive energy and the end of global wage competition, all of which are structurally inflationary.

In this context, the situation in Ukraine will precipitate a marked acceleration in inflation in the short term. Russia is the world’s second largest producer of natural gas (40% of Europe’s needs) and the world’s third largest producer of oil (10% of world supply). Russia and Ukraine account for 25% of world wheat exports, 21% of world hop exports and 17% of world maize exports. According to a study published by Coface, European inflation will increase by 1.5pp in 2022 due to the war in Ukraine.

After two decades during which China exported disinflation, the global context is moving towards de-globalisation, structurally more expensive energy and the end of global wage competition, all of which are structurally inflationary.

In this context, the situation in Ukraine will precipitate a marked acceleration in inflation in the short term. Russia is the world’s second largest producer of natural gas (40% of Europe’s needs) and the world’s third largest producer of oil (10% of world supply). Russia and Ukraine account for 25% of world wheat exports, 21% of world hop exports and 17% of world maize exports. According to a study published by Coface, European inflation will increase by 1.5pp in 2022 due to the war in Ukraine.

We believe that many investors are not prepared for the return of inflation.

The impact of inflation

In times of inflation, companies with strong pricing power, high margins and low capital intensity should do well. There will be a lot of disappointments to anticipate and many companies will find that their pricing power is less strong than expected. We are selective and favour, for example, technology companies in a monopoly situation (ASML, Palo Alto) or the world’s finest luxury brands (LVMH, Hermès). For the rest of the market, we believe that margins should normalise.

Our belief

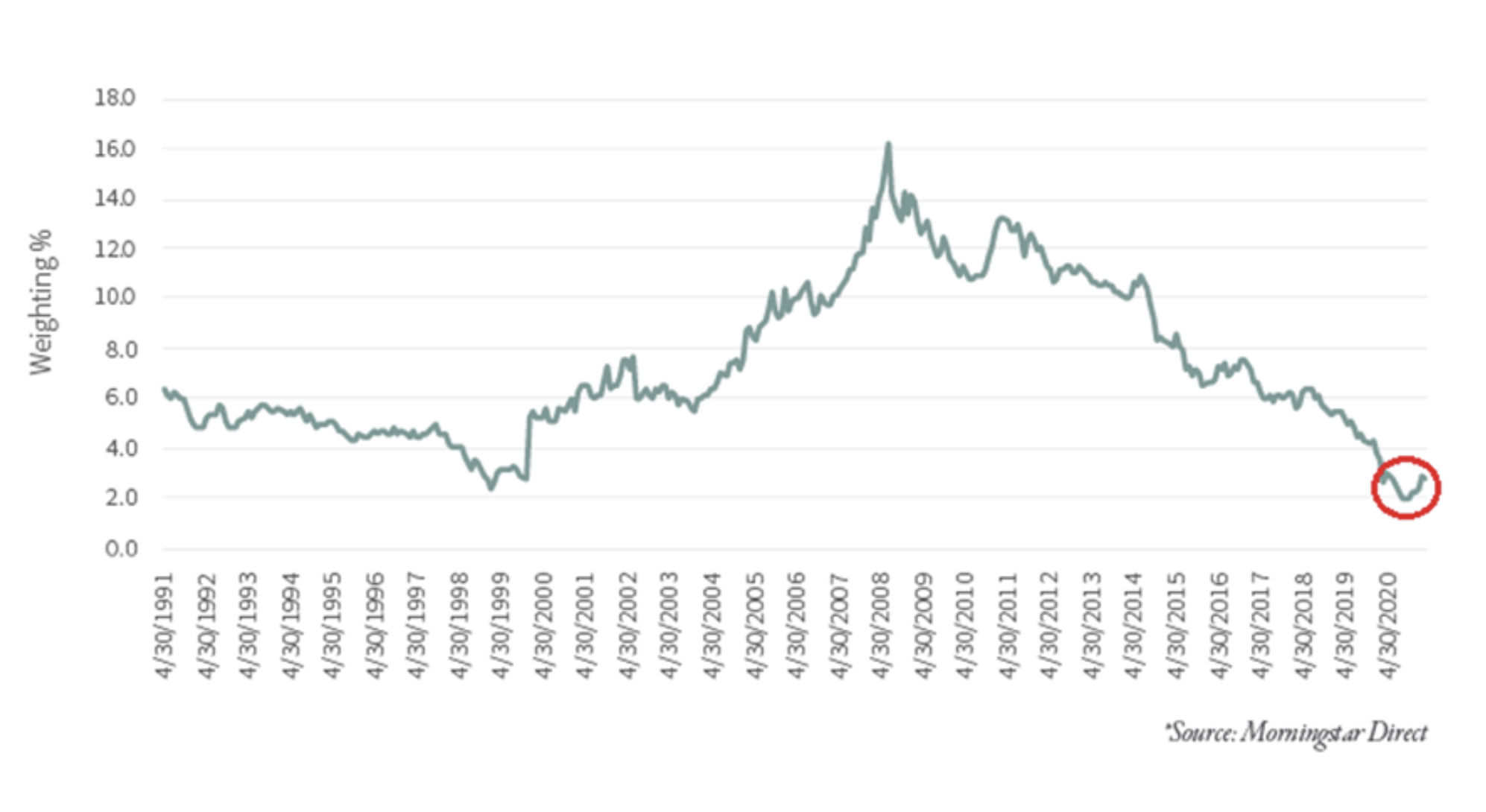

Commodities will become structurally more expensive and we are only at the beginning of a rebalancing between producers and consumers. Despite the recent rebound, the weight of the Energy Sector in the S&P is still at a low point with a long-term perspective, as illustrated in the chart below. Two statistics illustrate our conviction: the capex of the majors has fallen from $330bn to $140bn, and cannot accelerate again because of the “religion of ESG”. New reserve discoveries are only 5 million barrels per day (compared to 30 million at the peak), which corresponds to a replacement rate of 12%. We are therefore structurally in favour of producers, if possible with the freedom to increase their production and not directly exposed to production in Russia (Exxon, Aker, Occidental Petroleum).

Weight of the Energy sector in the S&P 1991 - 2021

Our belief is that central banks will have to prevent inflationary expectations from taking root and will have to raise rates. Financial stocks in the broad sense will benefit. Banks such as BNP Paribas or JP Morgan, insurers such as Axa, or payment companies such as Visa or Edenred whose revenues are indexed to nominal GNP could benefit.